Economic Value Corporate Wealth In the intricate dance of commerce and capitalism, the alchemy of Economic Value and the tapestry of Corporate Wealth unfold as chapters in the saga of business prowess. This discourse delves into the labyrinth of business valuation, wealth creation, and the underlying dynamics that shape the economic landscape.

Deciphering Economic Value

Unveiling the Essence of Economic Value

Economic Value is not a static figure; it’s a dynamic force that permeates every transaction, every business decision. It’s the essence that underpins the exchange of goods, services, and the very heartbeat of the market.

1. Utility Dynamics: Beyond Monetary Worth

Economic Value transcends mere monetary worth; it’s rooted in utility dynamics. It reflects the satisfaction and utility a product or service brings to consumers, illuminating the profound connection between value and the human experience.

2. Subjective Valuation: The Consumer Lens

The lens of Economic Value is subjective. It’s about understanding how individuals perceive and assign value to a product or service, acknowledging the diversity of consumer preferences and the ever-changing nature of market sentiments.

3. Innovation Impact: Value Amplification

In the grand narrative of Economic Value, innovation becomes a key protagonist. It’s the force that amplifies value, introducing new dimensions and functionalities that redefine consumer expectations and elevate the perceived worth of offerings.

The Kaleidoscope of Corporate Wealth

Illuminating the Pathways to Corporate Wealth

1. Financial Alchemy: Business Valuation

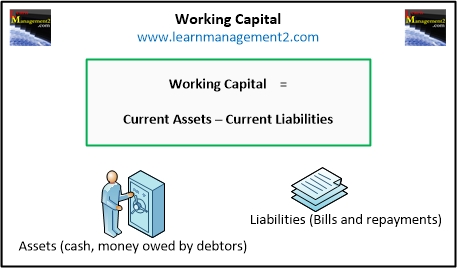

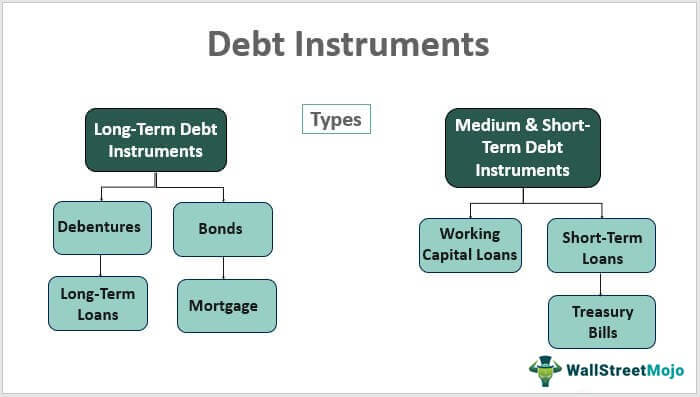

Corporate Wealth begins with financial alchemy – the intricate art of Business Valuation. It involves dissecting the financial anatomy of a company, understanding its assets, liabilities, and potential for future earnings.

2. Market Capitalization Majesty: The Stock Market Prism

Market capitalization becomes the prism through which Corporate Wealth is often viewed. It’s the culmination of market dynamics, investor sentiment, and the collective valuation bestowed upon a company’s shares, capturing the perceived value by the market at any given moment.

3. Intangible Wealth: Beyond Tangible Assets

In the realm of Corporate Wealth, intangibles hold substantial weight. Brand reputation, intellectual property, and the quality of human capital contribute to a company’s intangible wealth, often overshadowing the significance of tangible assets.

The Symphony of Business Valuation

Orchestrating the Art of Business Valuation

Business Valuation is not a monolithic process; it’s a symphony that harmonizes various methodologies, each playing a unique role in crafting the financial narrative of a company.

1. Income Approach Melody: Future Earnings Harmony

The income approach contributes a melody to the symphony, forecasting future earnings and discounting them to present value. It’s a forward-looking perspective that considers the potential economic value a business can generate.

2. Market Approach Rhythm: Comparative Beats

The rhythm of the market approach lies in comparative beats. It involves evaluating a business by comparing it to similar entities in the market, deriving a value based on the pricing multiples observed in comparable transactions.

3. Asset-Based Crescendo: Tangible and Intangible Crescendo

The asset-based approach crescendos with a focus on tangible and intangible assets. It appraises a company by assessing the value of its physical assets and intellectual capital, providing a baseline for understanding the company’s economic worth.

The Alchemy of Wealth Creation

Unraveling the Secrets of Wealth Creation

1. Innovation Elixir: Catalyst for Wealth

In the alchemy of Wealth Creation, innovation acts as a potent elixir. It transforms industries, creates new markets, and propels businesses to the forefront by introducing products or services that redefine the economic landscape.

2. Strategic Alliances Alchemy: Collaborative Wealth

Collaborative alchemy in the form of strategic alliances becomes a wealth creation catalyst. When companies join forces, whether through mergers, partnerships, or joint ventures, they unlock synergies that lead to shared economic value and increased corporate wealth.

3. Human Capital Alchemy: Talent as the Philosopher’s Stone

In the grand equation of Wealth Creation, human capital acts as the philosopher’s stone. The talent, skills, and creativity of a workforce can elevate a company’s performance, driving innovation, efficiency, and ultimately contributing to its economic value.

Challenges in the Economic Symphony

Navigating the Dissonance in Economic Value Dynamics

1. Market Volatility Crescendo: Unpredictable Beats

The crescendo of market volatility introduces unpredictable beats to the economic symphony. Companies must navigate the undulating waves of market sentiment, adapting their strategies to sustain economic value even in turbulent times.

2. Intangible Valuation Complexity: Evaluating the Unseen

The complexity in Business Valuation arises in the evaluation of intangible assets. Quantifying the value of brand reputation, intellectual property, and human capital involves intricate assessments that often defy traditional valuation metrics.

3. Global Economic Harmony: Synchronized Challenges

Synchronized challenges in the global economic arena add a layer of complexity. Companies must consider geopolitical shifts, international trade dynamics, and the interconnectedness of economies as they strive to create and maintain corporate wealth.

Innovations Shaping Economic Landscapes

Embracing Technological Alchemy in Economic Evolution

1. Big Data Analytics Alchemy: Insights Eruption

The eruption of insights comes through big data analytics alchemy. By harnessing vast datasets, companies gain profound insights into consumer behavior, market trends, and operational efficiencies, shaping their strategies for optimizing economic value.

2. Blockchain Wealth Security: Immutable Trust

Immutable trust is established through blockchain wealth security. The transparency and security offered by blockchain technology enhance trust in financial transactions, fostering an environment conducive to corporate wealth creation.

3. Artificial Intelligence Valuation: Predictive Wisdom

Predictive wisdom emerges from artificial intelligence-driven valuation models. Advanced algorithms can analyze diverse factors, foresee market trends, and provide nuanced insights into future economic value, guiding companies in strategic decision-making.

Completion : Economic Value Corporate Wealth

As companies traverse the labyrinth of Economic Value, Corporate Wealth, Business Valuation, and Wealth Creation, they engage in a symphony in constant flux. Each note played, whether the evaluation of economic value or the orchestration of wealth creation strategies, contributes to a dynamic narrative, shaping the destiny of organizations in the ever-evolving economic landscape.