Capital Structure Financial Mix In the intricate tapestry of corporate finance, businesses embark on a perpetual journey to discover the optimal arrangement of financial elements—a journey known as capital structure. This intricate dance involves understanding the nuances of financial composition, strategically curating a funding mix, and delicately balancing the debt-equity ratio. Join us as we navigate the financial waters, unraveling the complexities of capital structure and the art of crafting the perfect financial mix.

The Symphony of Financial Composition

Defining Capital Structure: The Architectural Blueprint of Finance

Capital structure, often referred to as the architectural blueprint of finance, delineates how a company chooses to fund its operations and growth. It’s a strategic concoction of debt and equity, each element playing a distinctive role in shaping the financial destiny of the enterprise.

Embracing the essence of capital structure is akin to understanding the architectural nuances of a building—a meticulous arrangement where each component contributes to the overall stability and functionality of the structure.

The Art of Financial Composition: Crafting a Symphony of Debt and Equity

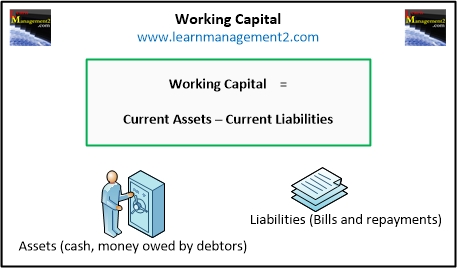

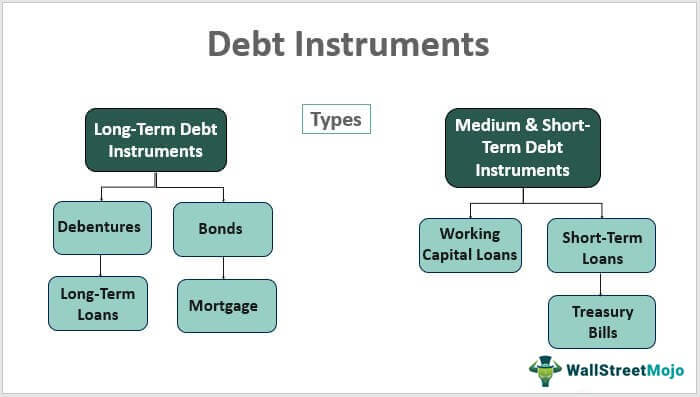

In the artful craft of financial composition, businesses engage in a symphony where debt and equity play distinct roles. Debt, with its structured repayments and interest obligations, resembles the sturdy pillars of financial support. Equity, on the other hand, represents the flexible and participatory aspect, akin to the artistic elements that add flair to the overall design.

Understanding the art of financial composition is akin to orchestrating a symphony where each instrument (debt or equity) contributes to the harmonic resonance of financial stability.

Unveiling the Funding Mix: Strategic Maneuvers in Financial Terrain

The Mosaic of Funding Mix: A Strategic Tapestry

The funding mix is the mosaic where businesses strategically weave debt and equity into a tapestry of financial resources. It’s not a haphazard arrangement but a strategic maneuver where businesses decide the proportion of debt and equity that best aligns with their financial goals and risk tolerance.

Embracing the intricacies of the funding mix is akin to being a master weaver, where each financial strand is not randomly placed but strategically intertwined to create a robust and resilient financial fabric.

Tailoring the Funding Mix: A Bespoke Approach

The funding mix is not a one-size-fits-all garment; it’s a bespoke attire tailored to fit the unique contours of each business. Companies, like skilled tailors, assess their financial landscape, risk appetite, and growth aspirations to craft a funding mix that complements their specific needs.

Understanding the tailored nature of the funding mix is akin to appreciating the craftsmanship of a bespoke suit—an artful creation where each stitch is purposeful and contributes to the overall elegance of the ensemble.

The Dance of Debt-Equity Ratio: Striking the Right Balance

Decoding the Debt-Equity Ratio: A Balancing Act

Central to the art of capital structure is the delicate dance of the debt-equity ratio. This financial metric quantifies the proportion of debt to equity in a company’s financing structure. Striking the right balance in this ratio is a strategic imperative—a balancing act that influences financial risk, cost of capital, and overall financial health.

Decoding the intricacies of the debt-equity ratio is akin to mastering the art of equilibrium—a nuanced understanding where the weight of debt and equity harmoniously coexists.

Optimal Debt-Equity Ratio: The Goldilocks Principle

Achieving the optimal debt-equity ratio is akin to adhering to the Goldilocks principle—not too much debt to avoid financial indigestion, not too much equity to dilute ownership stakes, but just the right mix to ensure a balanced and sustainable financial feast.

Understanding the Goldilocks principle in the context of the debt-equity ratio is akin to appreciating the finesse of finding the perfect equilibrium—a delicate balance where financial stability and growth are in harmonious alignment.

Crafting Financial Stability: The Symphony of Long-Term Success

The Harmonic Resonance of Financial Stability

In the symphony of corporate finance, achieving financial stability is the harmonic resonance that echoes with the strategic decisions made in capital structure. It’s not a fleeting note but a sustained melody where the careful arrangement of debt and equity contributes to the enduring success of the business.

Embracing the harmonic resonance of financial stability is akin to enjoying a symphony—a melodic journey where each note, each financial decision, contributes to the overall beauty of the composition.

Long-Term Success: A Overture of Strategic Financial Planning

Long-term success is not an instantaneous crescendo but a carefully orchestrated overture of strategic financial planning. Companies that master the art of capital structure engage in a continual symphony of financial planning, adapting their financial composition, funding mix, and debt-equity ratio to the evolving dynamics of the business landscape.

Understanding long-term success as an overture is akin to appreciating the strategic prowess of a composer—a visionary who anticipates the nuances of each movement and ensures the symphony endures across time.

Payoff : Capital Structure Financial Mix

In the everlasting sonata of financial strategy, the intricacies of capital structure, the art of financial composition, the strategic dance of the funding mix, and the delicate balance of the debt-equity ratio intertwine to create a masterpiece. It’s not a one-time performance but a continual sonata where businesses navigate the financial landscape with precision, adaptability, and a keen understanding of the financial symphony.

As companies embark on this perpetual financial journey, the symphony of capital structure becomes an everlasting sonata—an ongoing composition where each financial decision contributes to the enduring success of the business.