Cash Flow Key Metric In the intricate dance of financial metrics, Cash Flow Metrics emerge as the choreographer, orchestrating the movements that dictate the financial health and sustainability of a business. This article dives deep into the nuances of cash flow analysis, exploring the significance of Key Cash Generation, the intricacies of Financial Flow Metrics, and the pivotal role of Cash Performance Key in unlocking the doors to fiscal prosperity.

The Essence of Cash Flow Metrics

Decoding the Language of Financial Fluidity

In the realm of financial management, Cash Flow Metrics stand as the Rosetta Stone, unraveling the language of liquidity and financial fluidity. It’s not merely about profit and loss; it’s about understanding how cash moves within the intricate machinery of an enterprise.

1. Operating Cash Flow: The Financial Lifeblood

Cash Flow Metrics begin their symphony with operating cash flow, the financial lifeblood of any entity. This metric captures the cash generated or consumed by a company’s core operations, providing a clear snapshot of its ability to sustain day-to-day activities.

2. Free Cash Flow: The Surplus Symphony

Beyond the operational realm lies free cash flow, a symphony of surplus. This Key Cash Generation metric goes beyond daily operations, encapsulating the cash remaining after necessary investments in assets and operations. It represents the surplus available for growth, debt reduction, or rewarding stakeholders.

3. Net Cash Flow: Navigating Financial Tides

As the financial tide rises and falls, net cash flow navigates the waters. This Cash Performance Key encapsulates the overall movement of cash into and out of a business, offering insights into the ebb and flow that shapes the financial landscape.

Key Cash Generation: Strategies for Success

Unleashing the Power of Key Cash Generation

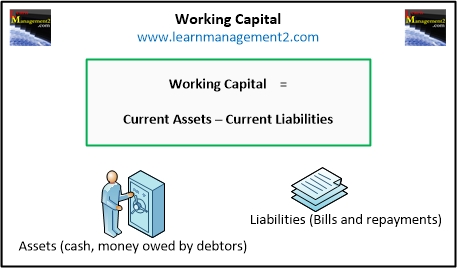

1. Optimizing Working Capital: The Rhythmic Balance

In the realm of Key Cash Generation, optimizing working capital is akin to achieving a rhythmic balance. Efficient management of receivables, payables, and inventory ensures that the business operates smoothly, minimizing cash tied up in non-income generating assets.

2. Capital Expenditure Efficiency: A Strategic Ballet

The efficiency of capital expenditure is a strategic ballet within Cash Flow Metrics. Striking the right balance between necessary investments and preserving cash liquidity requires a delicate dance, ensuring that capital is allocated where it can yield optimal returns.

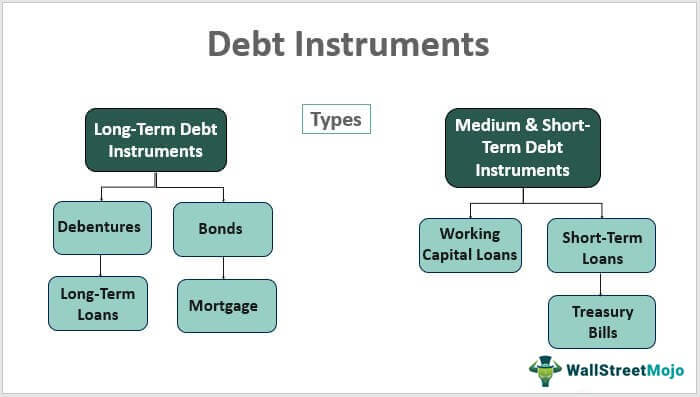

3. Debt Management Symphony: Harmonizing Liabilities

Key cash generation involves harmonizing the symphony of debt management. Balancing the use of debt to fuel growth while ensuring the sustainability of repayments is a strategic imperative within Financial Flow Metrics.

Financial Flow Metrics: Unlocking Insights

Unveiling the Layers of Financial Flow Metrics

1. Cash Conversion Cycle: The Pendulum of Efficiency

The cash conversion cycle swings as a pendulum of efficiency within Financial Flow Metrics. This metric measures the time it takes for cash to be invested in the production process, converted into sales, and eventually collected. A shorter cycle enhances liquidity and efficiency.

2. Accounts Receivable Turnover: Tempo of Collection

The tempo of collection is set by accounts receivable turnover. Within Cash Flow Metrics, this metric gauges how quickly a company collects payments from customers. A high turnover signifies effective credit management and a streamlined cash inflow.

3. Days Payable Outstanding: Balancing Act in Liabilities

Balancing the act in liabilities is seen through days payable outstanding. This Cash Performance Key measures the average number of days a company takes to pay its suppliers. Striking a balance ensures a favorable position in managing cash obligations.

Cash Performance Key: Strategies for Stability

Crafting Stability through Cash Performance Key

1. Cash Reserve Policies: Building Financial Fortresses

Within Cash Performance Key, cash reserve policies are the architects of financial fortresses. Establishing reserves for contingencies ensures a safety net during unforeseen circumstances, offering stability and resilience to weather economic storms.

2. Cash Flow Forecasting: Anticipating Financial Weather

Anticipating the financial weather is accomplished through cash flow forecasting. This strategic aspect of Key Cash Generation involves predicting future cash inflows and outflows, enabling proactive decision-making and positioning the business for financial success.

3. Investment in Marketable Securities: Balancing Liquidity and Returns

The balance between liquidity and returns is struck through investments in marketable securities. In Cash Flow Metrics, prudent investment strategies involve parking excess cash in securities that offer liquidity while generating a modest return, ensuring the preservation of capital.

Challenges in Cash Flow Management

Navigating Challenges in the Cash Flow Symphony

1. Seasonal Variability: Adjusting the Crescendo

The crescendo of seasonal variability poses challenges in the Cash Flow Metrics symphony. Businesses must adjust their financial instruments to accommodate fluctuations in cash flows during different seasons, ensuring stability amid variability.

2. Economic Downturns: Crafting Resilient Counterpoint

Crafting a resilient counterpoint becomes crucial during economic downturns. Key Cash Generation strategies must pivot to ensure not only survival but also to position the business for a robust rebound when economic conditions improve.

3. Overleveraging Risks: Striking a Harmonious Balance

Striking a harmonious balance in debt usage is imperative to avoid overleveraging risks. The allure of debt for growth must be tempered with a strategic approach to ensure that Cash Performance Key is not compromised by excessive liabilities.

Innovations in Cash Flow Management

Charting New Territories in Cash Flow Management

1. Blockchain in Receivables Management: Streamlining Transactions

Innovations like blockchain are streamlining transactions within Financial Flow Metrics. Utilizing blockchain in receivables management enhances transparency, reduces disputes, and expedites the collection process, contributing to a more efficient cash flow cycle.

2. Artificial Intelligence in Forecasting: Precision in Projections

The precision in projections is achieved through artificial intelligence in cash flow forecasting. AI algorithms analyze vast datasets, identify patterns, and enhance the accuracy of predicting future cash movements, providing strategic insights for Key Cash Generation.

3. Automated Cash Management Tools: Orchestrating Efficiency

Orchestrating efficiency is made possible through automated cash management tools. These tools streamline processes within Cash Performance Key, automating tasks such as reconciliations, payments, and reporting, freeing up resources for strategic financial decision-making.

Finale : Cash Flow Key Metric

Cash Flow Key Metric As businesses navigate the ongoing symphony of financial markets, the mastery of Cash Flow Metrics emerges as the conductor’s wand, directing the harmonious dance of liquidity and fiscal vitality. From Key Cash Generation strategies to the intricate maneuvers within Financial Flow Metrics and the pivotal role of Cash Performance Key, each note contributes to the resilience and success of an enterprise. In the dynamic world of finance, those who master the art of orchestrating cash flow are poised not just to survive but to thrive in the ever-evolving symphony of financial resilience.