Dividend Decision Shareholder Value In the intricate world of corporate finance, the decision-making process surrounding Dividend Policy is akin to navigating a complex labyrinth, where the strategic allocation of profits takes center stage. This article delves into the nuanced landscape of dividend dynamics, shedding light on how a well-crafted Dividend Policy can be the linchpin for elevating Shareholder Returns, optimizing Value Distribution, and fostering a culture of strategic Profit Sharing.

Unveiling the Essence of Dividend Policy

Dividend Policy Demystified: Balancing Acts and Strategic Calculations

Dividend Policy isn’t a one-size-fits-all concept; it’s a strategic calculus, a delicate balance between retaining earnings for growth and distributing profits to reward shareholders.

1. Payout Ratio Precision: Striking the Dividend Balance

The precision of the dividend dance lies in the Payout Ratio—the percentage of earnings distributed as dividends. Striking the right balance is crucial; too conservative a ratio, and shareholders may feel shortchanged; too liberal, and the company might jeopardize its growth prospects.

2. Stability in Volatility: The Dividend Resilience

In the volatility of financial markets, the resilience of dividends shines. A well-crafted Dividend Policy provides stability, assuring shareholders of a reliable income stream even in turbulent market conditions, fostering a sense of confidence and loyalty.

3. Dividend Frequency Dynamics: The Payout Cadence

The payout cadence, whether quarterly, semi-annually, or annually, adds another layer of strategy to Dividend Policy. It influences investor perceptions, cash flow dynamics, and the overall rhythm of value distribution.

The Shareholder Returns Odyssey

Navigating the Seas of Shareholder Value Creation

1. Dividend Yield Elegance: The Investor Allure

The elegance of Dividend Yield is its allure for investors seeking returns. It’s not just about capital appreciation; it’s a tangible reward for shareholder loyalty, a metric that entices income-focused investors to participate in the ownership journey.

2. Share Buybacks: The Strategic Repurchase

Beyond dividends, share buybacks enter the arena of Shareholder Returns. This strategic repurchase of company shares reduces the number of outstanding shares, magnifying ownership stakes and potentially boosting stock prices, creating additional value for shareholders.

3. Total Shareholder Return: The Holistic Metric

The holistic metric of Total Shareholder Return encapsulates dividends, share price appreciation, and the impact of share buybacks. It paints a comprehensive picture, capturing the overall value delivered to shareholders, guiding strategic decisions on Dividend Policy and other value-sharing mechanisms.

Value Distribution Dynamics

Strategic Choreography in Value Distribution

1. Earnings Retention: The Growth Fuel

While dividends share the limelight, earnings retention plays a pivotal role in Value Distribution dynamics. Retained earnings fuel growth initiatives, allowing companies to reinvest in operations, research, and development, laying the groundwork for future profitability.

2. Capital Expenditure Allocation: The Investment Symphony

The investment symphony within Value Distribution involves allocating funds to capital expenditure. This strategic deployment ensures that the company maintains and enhances its operational capabilities, a crucial aspect of sustainable value creation for shareholders.

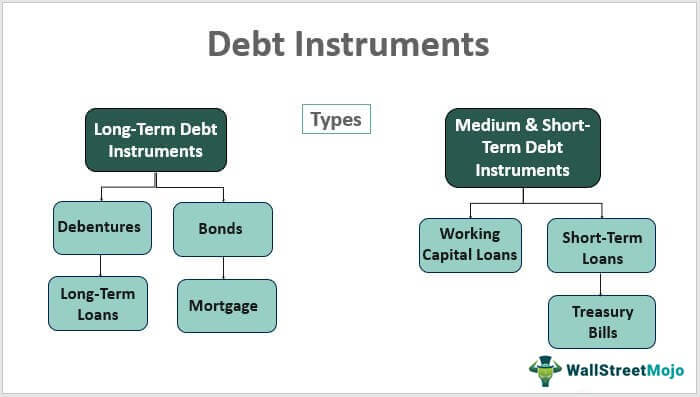

3. Debt Reduction Strategies: The Financial Symphony

In the financial symphony, debt reduction strategies harmonize with Value Distribution. Paying down debt enhances the company’s financial health, reduces interest payments, and bolsters shareholder confidence by mitigating financial risks.

Profit Sharing Principles

Cultivating a Culture of Strategic Profit Sharing

1. Employee Profit Participation: The Inclusive Approach

Beyond traditional shareholder dividends, an inclusive approach involves employee profit participation. Employee stock ownership plans (ESOPs) and profit-sharing schemes align employee interests with company performance, fostering a sense of ownership and dedication.

2. Stakeholder Engagement: The Community Connection

Expanding the scope of Profit Sharing involves community engagement. Corporations can allocate funds to social responsibility initiatives, environmental projects, or charitable causes, creating a positive impact beyond financial returns and enhancing the company’s reputation.

3. Strategic Reinvestment: The Growth Catalyst

Strategic reinvestment is a form of Profit Sharing with a future-forward focus. Allocating profits to research, innovation, and expansion projects positions the company for long-term success, benefiting shareholders through potential stock value appreciation.

Challenges in the Dividend Decision Arena

Confronting Challenges in Pursuit of Shareholder Value

1. Market Volatility: The Strategic Tightrope

The strategic tightrope in the dividend decision arena is market volatility. Companies must navigate the balance between consistent dividends and the need for financial flexibility during uncertain economic conditions, adapting Dividend Policy to suit the prevailing market dynamics.

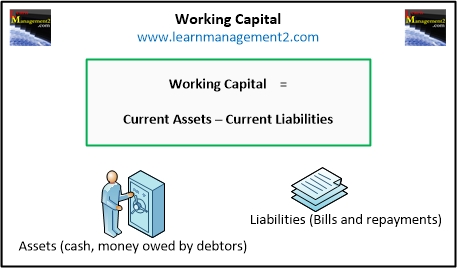

2. Cash Flow Variability: The Liquidity Dilemma

The liquidity dilemma arises from cash flow variability. Companies must manage cash reserves judiciously, ensuring there’s enough liquidity to sustain dividend payments without compromising their ability to cover operational expenses or undertake strategic investments.

3. Regulatory Constraints: The Compliance Challenge

Navigating regulatory constraints is a compliance challenge in the dividend decision landscape. Different jurisdictions have varying regulations regarding Dividend Policy, necessitating a nuanced approach to ensure compliance while maximizing shareholder value.

Innovations Shaping Dividend Dynamics

Embracing Innovations for Strategic Shareholder Value Creation

1. Blockchain in Dividend Distribution: The Transparent Ledger

The transparent ledger in dividend distribution is blockchain technology. By leveraging blockchain, companies can enhance transparency, streamline dividend distribution processes, and provide shareholders with real-time insights into dividend transactions.

2. AI-Driven Dividend Forecasting: The Predictive Sentry

The predictive sentry in dividend dynamics is AI-driven forecasting. Advanced algorithms analyze financial data, market trends, and company performance, providing insights for more accurate dividend forecasting and strategic decision-making.

3. Smart Contracts in Profit Sharing: The Automated Covenant

In the realm of profit sharing, smart contracts emerge as the automated covenant. By utilizing smart contracts on blockchain platforms, companies can automate profit-sharing processes, ensuring accurate and timely distribution of profits to shareholders, employees, and other stakeholders.

Consequence : Dividend Decision Shareholder Value

As organizations navigate the labyrinth of Dividend Policy, shareholder returns, value distribution, and profit sharing, the mastery of financial orchestration becomes the conductor’s wand. Each note in this symphony contributes to the overall shareholder value creation, guiding companies toward resilience, stability, and sustained success in the ever-evolving landscape of corporate finance.